VessOnSecurity

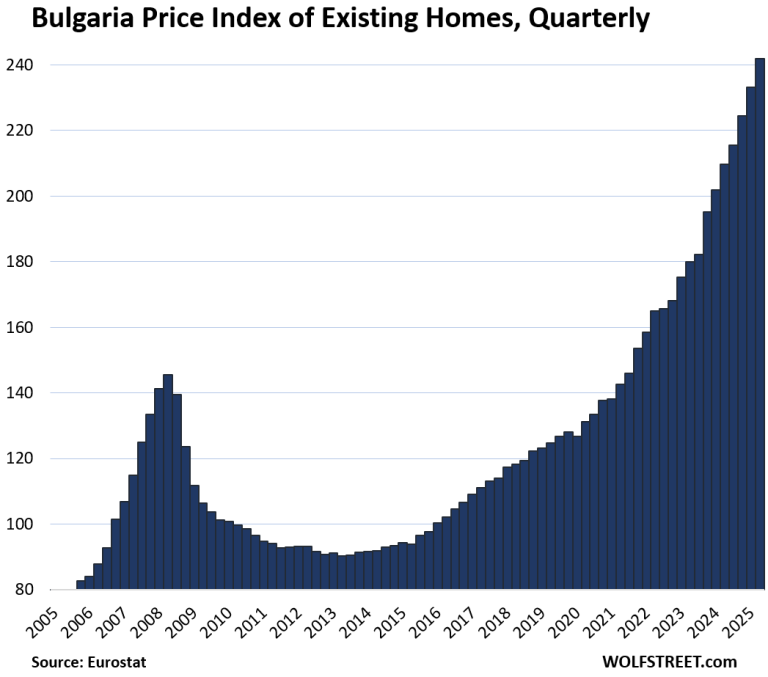

bontchev@infosec.exchangeHome prices in my country for the past two decades. Tell me again how the anticipation of the introduction of the euro doesn't lead to inflation?

VessOnSecurity

bontchev@infosec.exchangeAh, this probably requires some explanation...

When we still had a local currency, the banks were required to keep reserves in our national bank. Now that we've switched to euros, they are required to keep the reserves at the ECB. Problem is, those required reserves are about FOUR TIMES smaller. Which frees BILLIONS of bank capital. And since banks mostly do business by selling mortgages, it means they have more money to lend for such mortgages. Increased money supply leads to increased prices of real estate.

Of course, that's just the immediate effect. Eventually, the money will find its way elsewhere in the economy and, combined with several other factors that I can't be assed to cover here, will lead to higher prices of everything for everyone, or "inflation", as it is currently called.

Kevin Karhan

kkarhan@infosec.space

@bontchev Gentle inflation is common and deflation is avoided as shrinkage.

That being said the purchasing power should've been raised over a longer term.

On the flipside I'm convinced there's a higher rate of homeowners in Bulgaria than Germany...

stf

stf@chaos.social@bontchev dutch had euros for long time, their prices also went up 500 % https://www.globalpropertyguide.com/europe/netherlands/home-price-trends

GeorgeK

georgek@mastodon.green@buherator @bontchev yeah, Hungary popped to my mind. Perhaps the real story here is that the perception of stability leads to foreign investment? Probably relatively easy to validate this "theory" assuming the data is available. Which is most probably not :-(

adingbatponder  👾

👾

adingbatponder@fosstodon.org

@bontchev I was told it was due to people having to convert cash piles of the old currency into property to avoid issues with tax thereon, and thus a seller's market combined with lots of cash from individuals being "released" suddenly. Can this be true?

VessOnSecurity

bontchev@infosec.exchange@adingbatponder Unlikely. Cash on hand can be hidden and is threatened only by inflation, while if you convert it into real estate, the government knows about it and you have to start paying property tax.

The only alternative explanation is that people buy real estate as an investment and as a hedge against inflation.

Not sure about income; I don't know what percentage of the second homes are being rented out but there were some government officials complaining that many houses are empty.